Trading Engine

The heart of our ecosystem

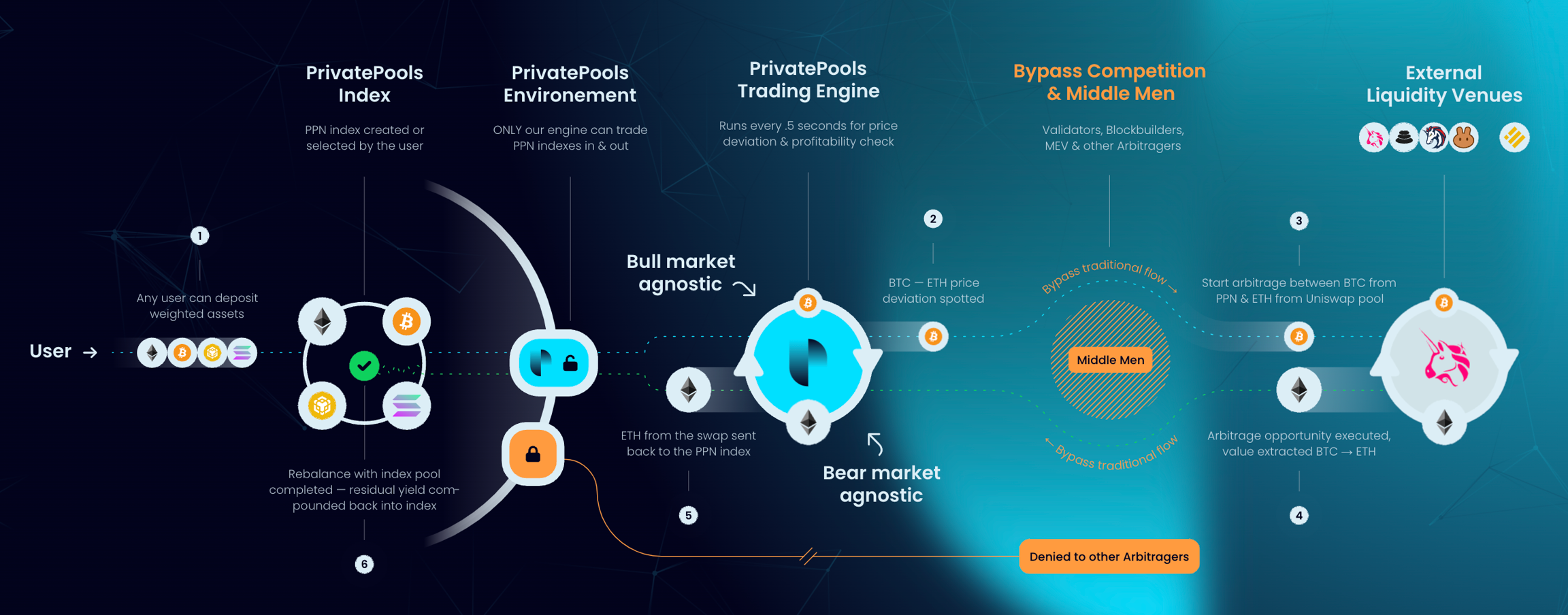

The purpose of the Private Pools Network Trading Engine is to maintain the asset ratios of each individual Private Index Pool in alignment with the broader market and generate returns by executing rebalancing sequences throughout the arbitrage process (the means to which value is extracted from volatility). This engine is an independent system within the ecosystems architecture, comprising multiple sub-components that include both smart contract frameworks and off-chain logic modules.

As depicted in the diagram above, the trading engine governs the logic for our strategy that extracts value from volatility. It is seeded with funds to execute arbitrage opportunities from external liquidity sources. It spots external arbitrage opportunities by querying pool balances within DeFi liquidity, and spreads on centralized orderbooks, every half a second. When its logic spots an opportunity to extract value from volatility, it will be triggered to either buy or sell from an external liquidity source, realizing the profit from executing each arbitrage opportunity, by rebalancing our Private Index Pools, just like any standard arbitrage process. By restricting access to our Private Index Pools, enabling only our trading engine to interact with these pools, we establish a privatized order flow, which is what separates us from the rest. The benefit here is that in doing so, we not only cut out block builders and middle men (extracting up to 80% more value by circumventing PGA's), but we also create value extraction opportunities that are exclusive to our ecosystem, eliminating competition as a result. This enables us to corner the market and monetize the negative effects of liquidity provision, extracting value that is otherwise lost in traditional LP's.