Introduction

Welcome to the Private Pools Network (PPN) documentation! Here, you'll find all the information you need to get started with and effectively utilize the features offered by out protocol.

Empowering Access to Automated Arbitrage Strategies

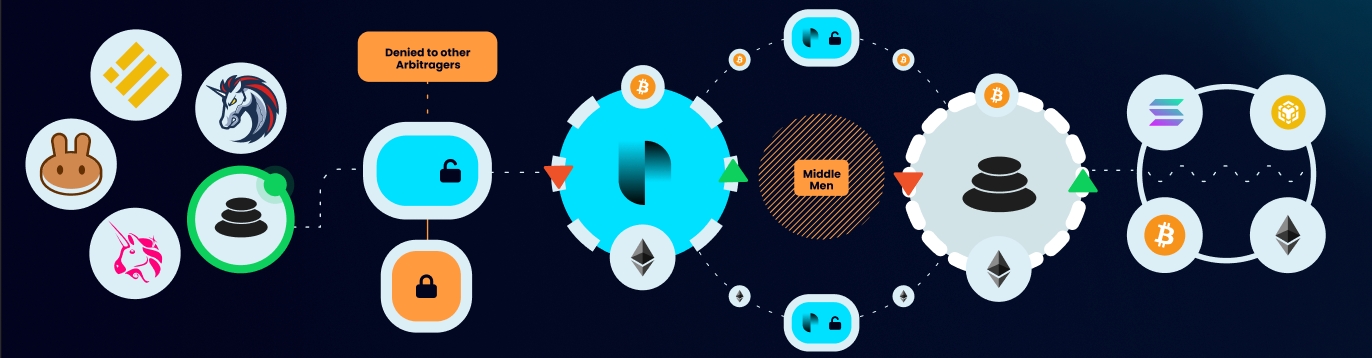

The liquidity you deposit into our ecosystem is used as counter liquidity for rebalancing pools in the arbitrage process. By privatizing the flow of this liquidity we eliminate competition and circumvent middle men meaning we extract more value. The choice is simple, you can arbitrage with us or be arbitraged by us. We extract value where value is lost in traditional AMM settings.

High-Level Introduction

A high-level view of the Private Pools Network describes the system as a blockchain-based architecture focused on a fully automated index fund creation, deployment, and management.

These Index funds "Private Index Pools" (PIP's) are a novel approach to incentivising liquidity and extracting value from external liquidity sources. In short, Private Pools Network can be described the worlds first "Fully Automates, Decentralized, Non-custodial, On-chain Market Maker.

PPN's smart contract ecosystem allows the user to deploy liquidity into a wide range of asset compositions (Indexes), providing diverse exposure to the crypto market. With automated rebalancing capabilities, our system maintains the assets in the index pools at balance with the open market according to the preconfigured weights while generating yield for our users in the process of rebalancing, achieved through our algorithms via automated arbitrage trading engine logic.

Last updated