Business Model

This page describes our business model providing insight into how our ecosystem extracts and distributes yield from volatility.

Overview

Our business model revolves around extracting value from volatility rather than fees, and reinvesting it into our ecosystem, eliminating competition and middlemen in the process. This market-agnostic approach thrives in both bear and bull markets, further reinforcing our project’s strength. So long as there is volatility, our product continues to build momentum.

Business Model Flow

Our solution creates a liquidity environment that privatizes order flow, fully automated for user convenience. Below we unpack the steps to which our business model extracts yield from market volatility.

Index Pools

Our solution starts with the conception of "Private Index pools". These pools are specifically designed for "private trading", they are not your traditional AMM pool.

Our index pools target extraction of value / yield from external liquidity sources. Where a standard AMM LP battles to extract value from swap fees, our pools extract value from other liquidity pools as they face volatility within the market. This creates deviations between the prices in our pool and external pools, allowing us to "Buy Low (from our Indexes) & Sell High (on external pools), or Sell High (on external pools) & Buy Low (from our Indexes), extracting yield from the deviation between both pools.

In the process of arbitrage, our index pools are used to balance out the price deviation between external liquidity (say on UniSwap or Binance) and our internal liquidity.

Exclusive Liquidity Environment

The next step in our business model flow involves privatizing order flow. We do this by permissioning only our Trading Engine to interact with our index pools.

We privatize order flow for a couple of reasons.

Privatizing order flow means external actors (arbitragers, MEV bots, retail DeFi users) cant interfere with our liquidity system. Essentially this means we eliminate any competition by creating an exclusive liquidity environment.

By establishing an exclusive liquidity environment, eliminating competition, we also circumvent exposure to "Priority Gas Auctions" (PGA's). This means we aren't having to place high bids for block space to extract value form our opportunities. The result means we optimize the yield we extract from the arbitrage process, allowing us to extract up to 80% more yield than other arbitragers, by avoiding PGA's.

Volatility Value Extraction

Having established an exclusive liquidity environment, our trading engine is now free to interact between our index pools and external liquidity pools. When market prices fluctuate, different liquidity sources offer varying rates (e.g The price of ETH on Sushi will almost always vary compared to the price of ETH on UniSwap). Our trading engine identifies these discrepancies and selects the most profitable trades to generate yield.

By rebalancing our index pools based on these price differences, we keep our indexes stable while capitalizing on external price deviations. The difference between our buy or sell prices in these external markets results in net yield for our ecosystem. This is how we profit from market volatility.

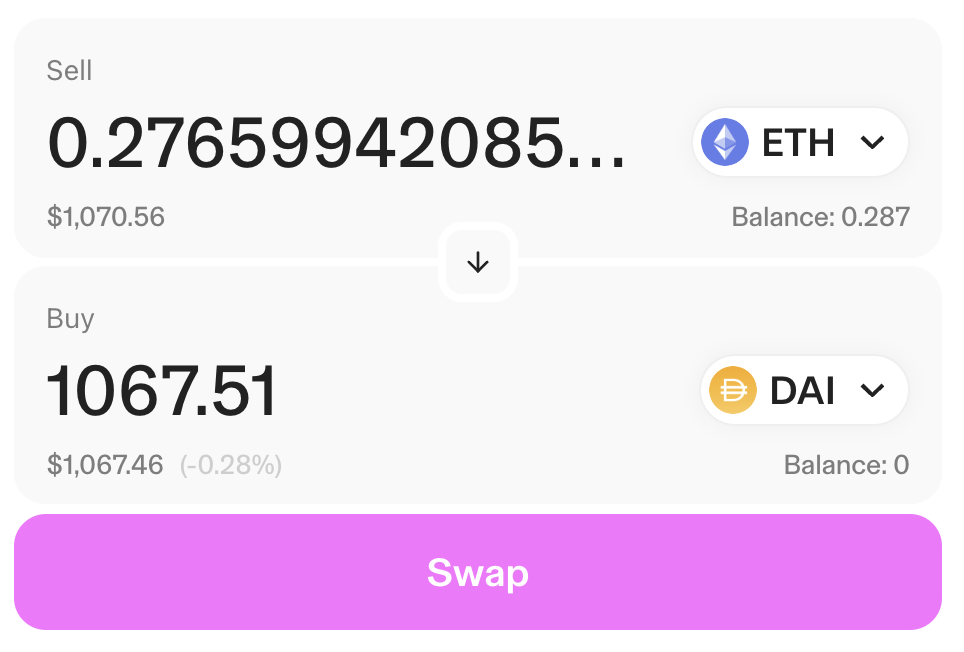

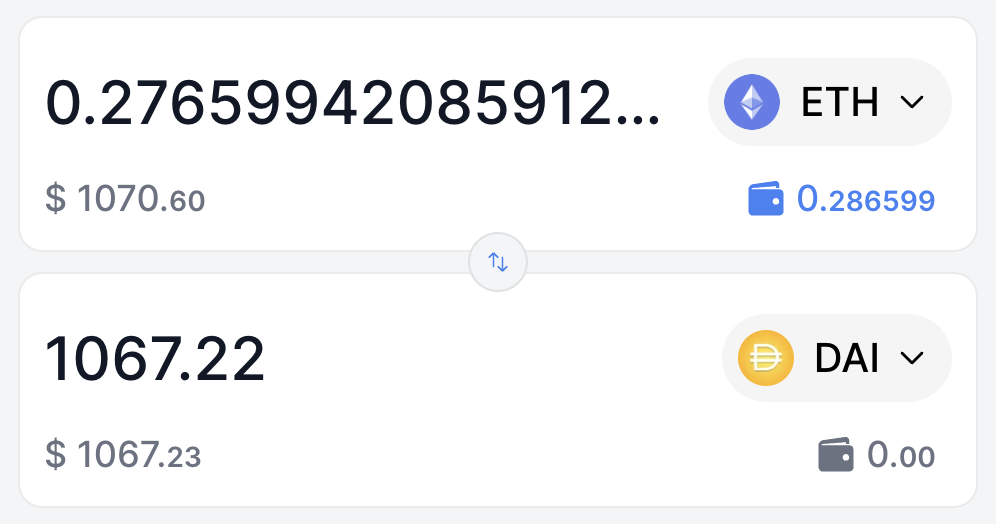

Example: As a very basic example of price deviations, we see below that the price for selling the exact same amount of ETH on Uniswap vs. SushiSwap is different. There is a $0.29 difference offered between SushiSwap and Uniswap on this trade. While this is a very minuscule example, the opportunity remains. This is the deviation opportunity that Private Pools Network capitalizes on.

Rebalancing & Yield Distribution

After the opportunity is executed by the trading engine and pools are rebalanced bringing them in sync with external market rates, the amount left over is treated as yield for the protocol and distributed according to our Yield Distribution section.